5 Life Events That Can Impact Your Finances—and How to Prepare Before They Happen

We’ve all experienced life’s plot twists?

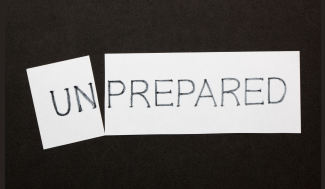

Whether you are prepared or not is inconsequential. They arrive without warning, often carrying financial burdens in their wake.

A layoff. A diagnosis. A parent who needs help. These moments don't come with instruction manuals, but they do come with price tags, deadlines, and decisions that can echo for years.

The good news? You can start planning today—long before life’s crossroads appear. Preparation now means confidence later.

Here are five turning points that tend to catch people off guard, and what you might consider doing before they arrive.

When a Marriage Ends

No one walks down the aisle expecting a divorce. Yet when it happens, the financial impact can unravel years of progress faster than most anticipate.

Legal fees accumulate quickly. For many women, income often drops sharply after a split.1 And later-life divorces can hit retirement savings hard—just when recovery time is limited.

For women especially, income often drops sharply after a split.1 And gray divorce—separating later in life—can hit retirement savings particularly hard, right when there's less time to recover.

The emotional weight is heavy enough. The financial side doesn't have to blindside you too.

If this transition is part of your story (or might be), consider taking inventory now: assets, beneficiaries, account access, retirement timelines. Knowing where you stand can help you move forward with more clarity.

When You Receive an Inheritance

An inheritance rarely arrives at a convenient time. It often shows up in the middle of grief, without warning, and with more questions than answers.

Here's what makes it harder: about two-thirds of high-net-worth parents haven't told their kids what they'll inherit—or whether they'll inherit anything at all.2 That silence can turn a meaningful gift into a source of confusion, guilt, or missed opportunity.

Before you act, pause. There's no rule that says you have to do something with the money immediately.

Cover any pressing tax obligations. Give yourself time to grieve. Then, when you're ready, think about what this inheritance could mean for your bigger picture—not just your bank account.

Intention beats impulse.

When Caregiving Calls

Stepping in to care for a loved one is one of the most selfless acts you can make—and one of the most financially demanding. The reality? Nearly 80% of family caregivers spend an average of $7,200 a year out of pocket.3 Prescriptions. Gas. Home modifications. Time away from work. The expenses may start small, but over time they accumulate—quietly eroding your budget and amplifying the stress.

Many caregivers don’t realize they’re sacrificing their own financial security until they’re already stretched thin. That’s why planning ahead matters. If caregiving is on your horizon—or already part of your life—build it into your broader financial strategy. Ask yourself:

- What can I realistically afford to give—financially, logistically, and emotionally—without jeopardizing my own future?

This isn’t selfish. It’s sustainable. Preparing now ensures you can support your loved one without putting your long-term goals at risk.

When Your Career Shifts

Starting a new job often feels like a fresh chapter—new team, new energy, new possibilities. But amid the excitement, it’s easy to overlook critical financial details.

Nearly one in three workers cash out their retirement accounts when leaving a job, potentially triggering taxes and penalties that can erode years of savings. 4 Others forget to enroll in benefits, miss health coverage gaps, or leave employer matches on the table.

The transition window is short, but the impact can last for decades. Before you settle into your new routine, take a moment to:

- Roll over your old 401(k)

- Review your new benefits package

- Adjust your financial goals if your salary changed

A few intentional steps now can help you maintain momentum and keep your long-term plans on track.

When Retirement Arrives

Retirement is the milestone most people spend decades working toward, but when it finally arrives, the sheer number of decisions can feel overwhelming.

When should you claim Social Security? Which accounts should you draw from first? How do you turn a pile of savings into reliable income that lasts?

Get these choices wrong, and you could end up paying more in taxes, running out of money sooner, or leaving valuable benefits on the table.

The stakes are high—but so is the opportunity. A well-timed, well-structured plan can stretch your resources further and give you more flexibility to enjoy the life you've built.

Don't wait until you're already retired to think it through. It’s important to stress-test your strategy while you still have options.

Bringing It Together

Divorce. Inheritance. Caregiving. Career changes. Retirement.

These aren't just life events—they're inflection points where emotions run high and financial decisions follow close behind.

You may not get to choose when they happen. But you can choose how prepared you are when they do.

Partnering with a financial professional can help you think through the "what ifs" before they become urgent "what nows." It's not about having every answer. It's about having a clear plan—and someone in your corner when life throws a curveball.

If change is already here, or just over the horizon, start the conversation today.

You don't have to figure it out alone.

Sources:

- University of Michigan's Population Studies Center, 2025 [URL: https://psc.isr.umich.edu/news/research-shows-economic-consequences-of-divorce-in-the-us-vary-by-gender-race-and-ethnicity]

- CNBC, 2025 [URL: https://www.cnbc.com/2025/11/25/how-to-talk-to-your-adult-children-about-their-inheritance.html]

- AARP, 2024 [URL: https://www.aarp.org/pri/topics/ltss/family-caregiving/financial-supports-family-caregivers/]

- Yahoo! Finance, 2025 [URL: https://ca.finance.yahoo.com/news/why-its-easier-now-to-help-job-changing-americans-hang-on-to-their-savings-143319442.html]

This content is developed from sources believed to be providing accurate information. The information provided is not written or intended as tax or legal advice and may not be relied on for purposes of avoiding any Federal tax penalties. Individuals are encouraged to seek advice from their own tax or legal counsel. Individuals involved in the estate planning process should work with an estate planning team, including their own personal legal or tax counsel. Neither the information presented nor any opinion expressed constitutes a representation by us of a specific investment or the purchase or sale of any securities. Asset allocation and diversification do not ensure a profit or protect against loss in declining markets. This material was developed and produced by Advisor Websites to provide information on a topic that may be of interest. Copyright 2026 Advisor Websites.